Portfolio rebalancing is a strategy used to maintain a desired allocation of assets in your investment portfolio—such as cryptocurrencies, stocks, or other assets—over time. It helps manage risk and ensures your investments stay aligned with your financial goals.

How It Works

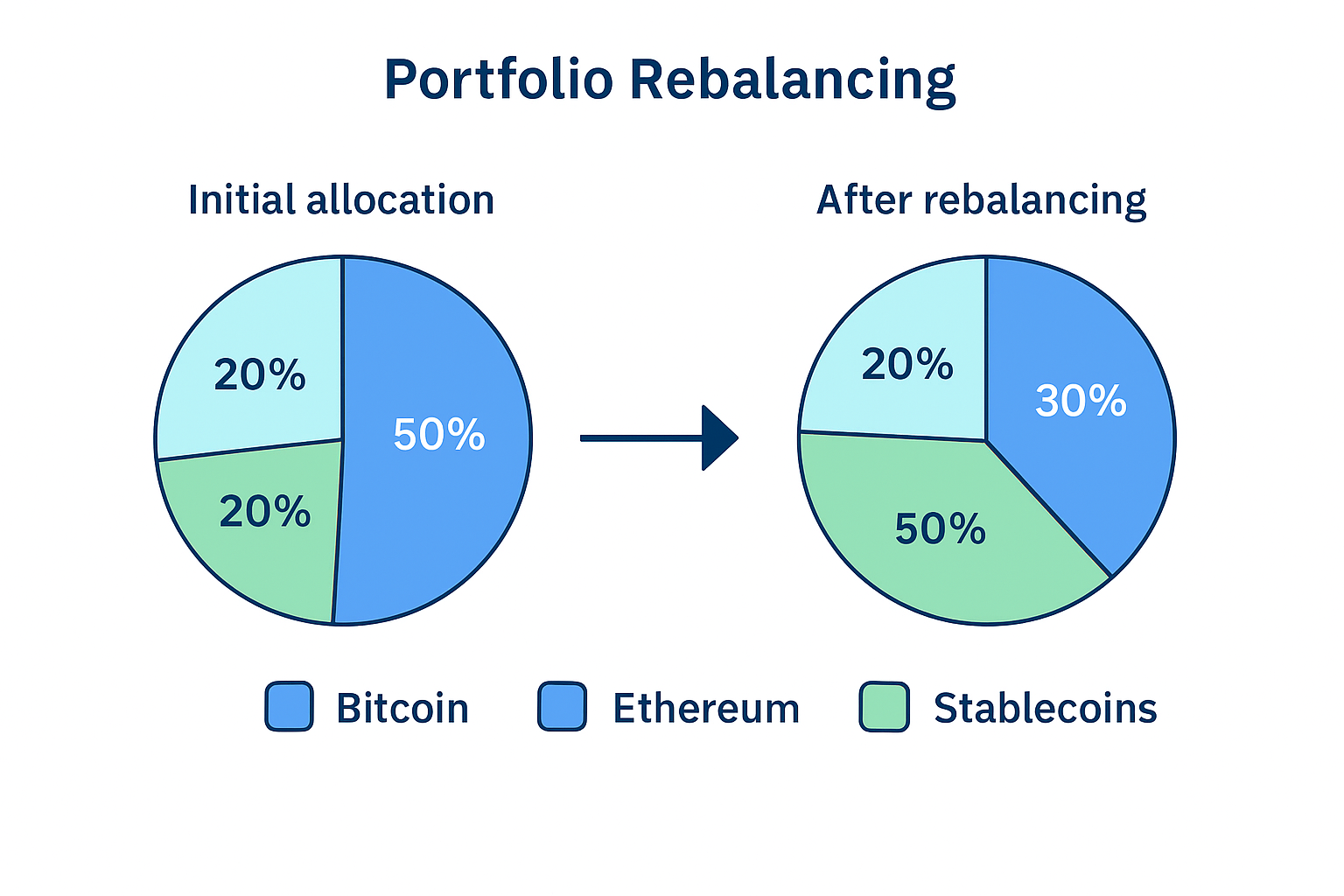

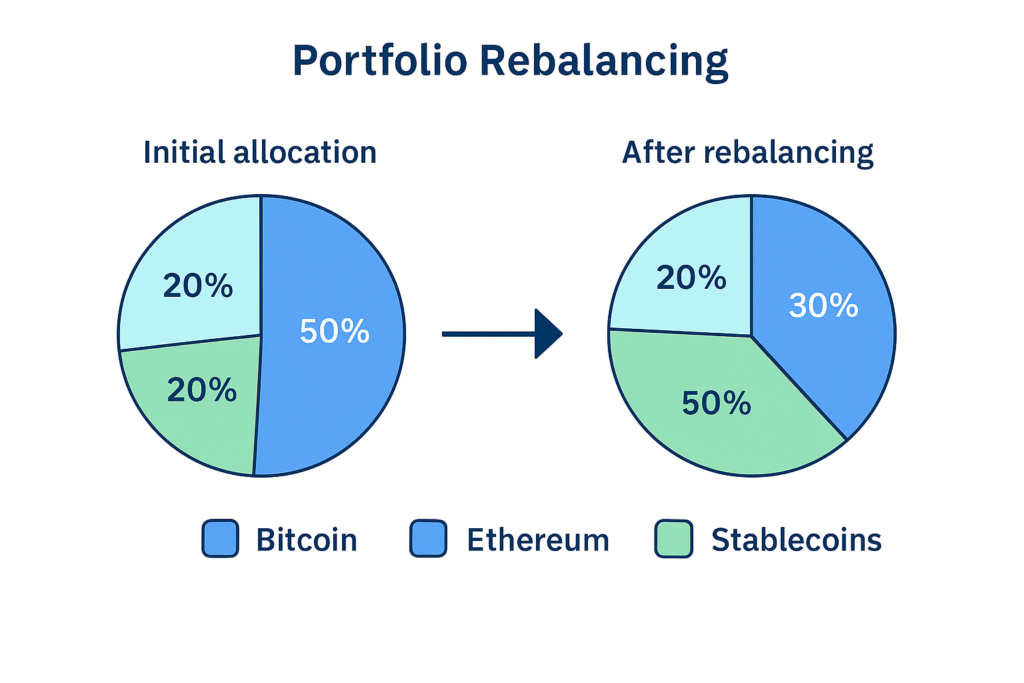

Let’s say your target allocation is:

- 50% Bitcoin (BTC)

- 30% Ethereum (ETH)

- 20% Stablecoins

Over time, due to market fluctuations, your portfolio might shift to:

- 60% BTC

- 25% ETH

- 15% Stablecoins

Rebalancing means adjusting your holdings back to the original target by:

- Selling some BTC

- Buying more ETH and Stablecoins

Why It’s Important

- Controls risk: Prevents overexposure to volatile assets

- Locks in gains: Sells high-performing assets and buys underperforming ones

- Maintains discipline: Keeps your strategy consistent, avoiding emotional decisions

How AI Helps

AI-powered platforms automate this process by:

- Monitoring your portfolio in real-time

- Analyzing market trends and volatility

- Rebalancing at optimal times (e.g., monthly, when thresholds are crossed)

Bots like 3Commas, Pionex, and Shrimpy offer automated rebalancing features with customizable settings.