AI has significantly impacted trading in financial markets by introducing speed, precision, and data-driven decision-making. Here’s how:

1. Algorithmic Trading

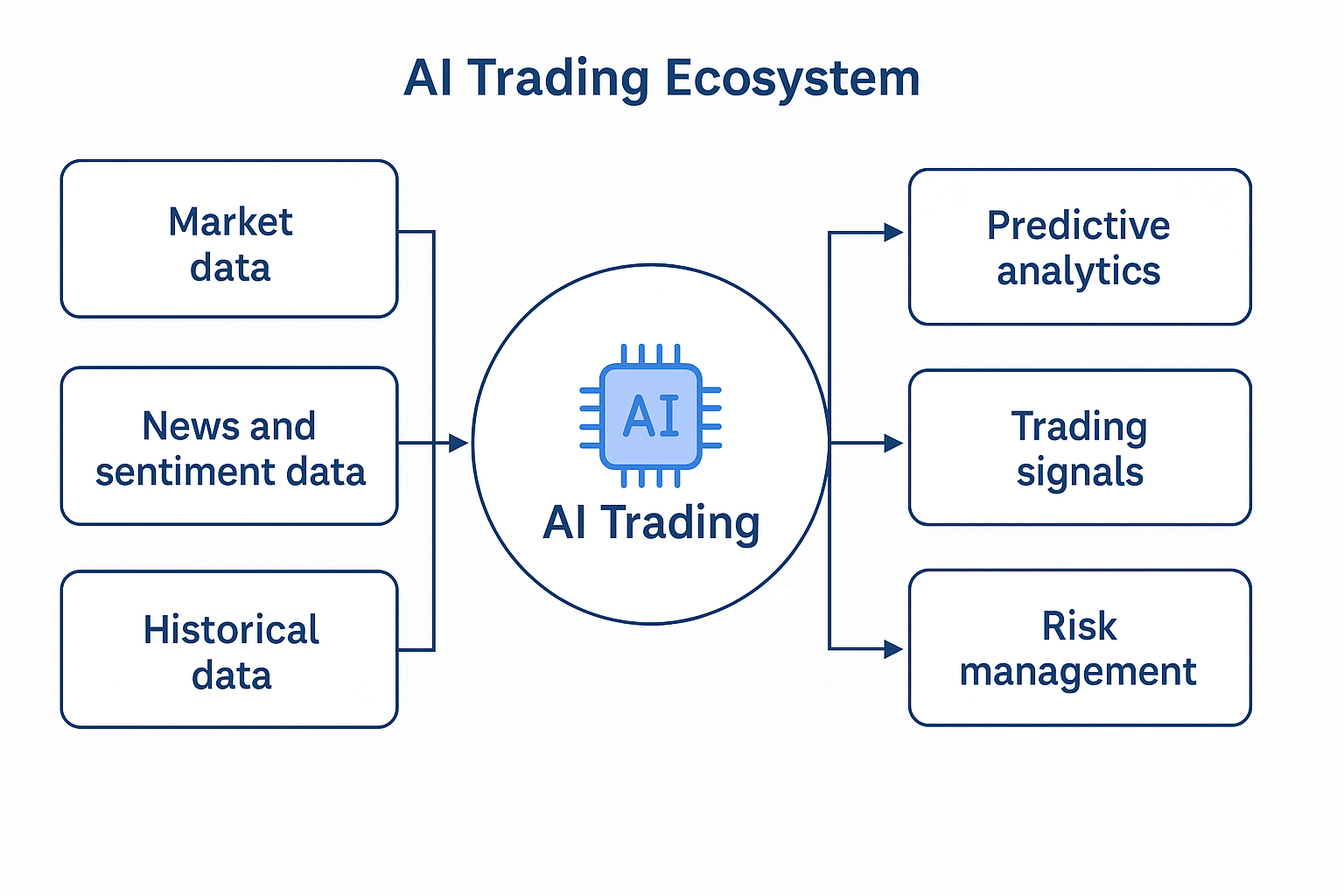

AI powers algorithmic trading, where machines execute trades based on predefined criteria. These algorithms analyze market data in real-time and make split-second decisions, often faster than any human could. This leads to:

- Higher trading volumes

- Reduced transaction costs

- Improved liquidity

2. Predictive Analytics

AI models use historical data, news sentiment, and even social media trends to predict market movements. Machine learning algorithms can identify patterns and correlations that are not obvious to human analysts, helping traders anticipate price changes and adjust strategies accordingly.

3. Sentiment Analysis

Natural Language Processing (NLP) allows AI to scan news articles, earnings reports, and social media to gauge market sentiment. This helps traders understand how public perception might influence asset prices and make more informed decisions.

4. Risk Management

AI helps traders manage risk by:

- Monitoring portfolios in real-time

- Simulating various market scenarios

- Automatically adjusting positions to minimize losses

This is especially useful in volatile markets where quick reactions are crucial.

5. High-Frequency Trading (HFT)

AI is central to HFT, where thousands of trades are executed in milliseconds. These systems rely on:

- Real-time data feeds

- Low-latency infrastructure

- Advanced AI models to identify arbitrage opportunities

6. Personalized Trading Strategies

Retail investors benefit from AI-driven platforms that offer customized trading strategies based on their risk appetite, investment goals, and market behavior.

Challenges and Risks

Despite its advantages, AI in trading also poses risks:

- Market manipulation through coordinated algorithmic behavior

- Flash crashes due to rapid, automated sell-offs

- Lack of transparency in decision-making processes

Regulators are increasingly focused on ensuring that AI-driven trading remains fair and stable.